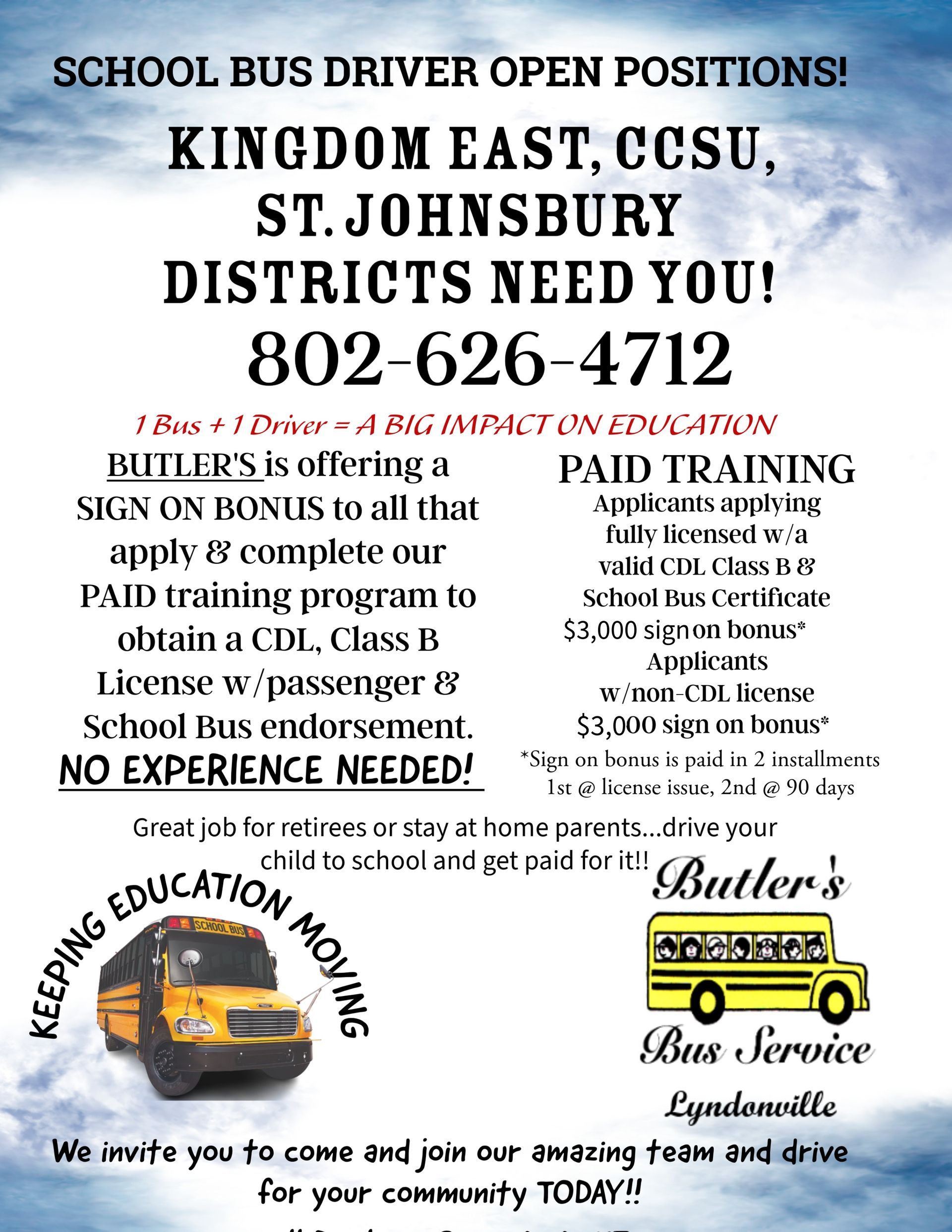

BUS DRIVERS WANTED!!

Butler's Bus Service is in need of bus drivers for the 2025-2026 school year!

They are currently offering a SIGN ON BONUS to all that apply & complete our PAID training program to obtain a CDL, Class B License w/ passenger & School Bus endorsement. NO Experience Needed!

Call Darlene at 802 626-4712 to learn more, or to apply!

DISTRICT OFFICE

64 Campus Lane

Lyndon Center, VT 05850

Phone: (802) 626-6100

Fax: (802) 626-3423

QUICK LINKS

BUS DRIVERS WANTED!!

Butler's Bus Service is in desperate need of bus drivers for the 2025-2026 school year!

They are currently offering a SIGN ON BONUS to all that apply & complete our PAID training program to obtain a CDL, Class B License w/ passenger & School Bus endorsement. NO Experience Needed!

- Applicants applying fully licensed w/ a valid CDL Class B and School Bus Certificate $2,000 sign on bonus!

- Applicants w/ a non CDL license $1,500 sign on bonus!

- Applicants applying fully licensed w/ a valid CDL Class B and School Bus Certificate $2,000 sign on bonus!

- Applicants w/ a non CDL license $1,500 sign on bonus!

Call Tina Burgoyne at 978-868-3278 to learn more, or to apply!

All Rights Reserved | Kingdom East Unified Union School District

All Rights Reserved | Kingdom East Unified Union School District